UK borrowing costs set to stay the same despite inflation hitting 2% target

Most economists are expecting policymakers to hold UK interest rates at 5.25% when the central bank announces its latest decision.

Borrowers hoping for some relief from higher costs are likely to be disappointed by expectations that UK interest rates will not be cut on Thursday, despite inflation returning to target.

Most economists are expecting policymakers to hold UK interest rates at 5.25% when the central bank announces its latest decision.

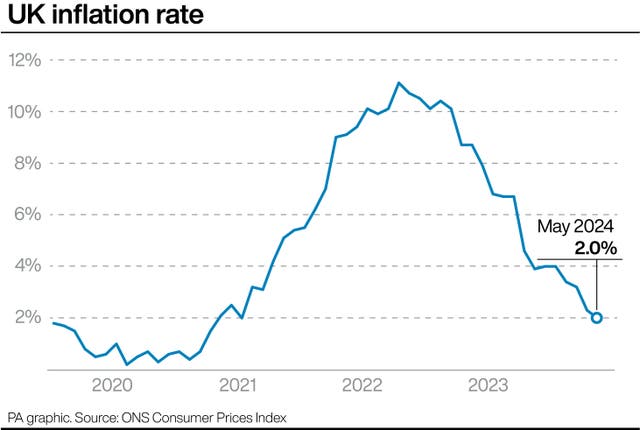

The announcement will come a day after official figures showed that inflation returned to the 2% target last month, for the first time since July 2021.

Rishi Sunak declared “we’ve got there” after the milestone was confirmed, insisting that it shows the economy has “turned the corner” after a long stretch of above-target inflation.

It raised questions over whether interest rates, which are used by the central bank as a tool to control inflation, could now be eased.

But experts cautioned that a rate cut this summer could be less likely until the majority of the Bank’s Monetary Policy Committee (MPC) feel certain that inflation is under control.

Crucially, the rate of services inflation, which looks only at service-related categories like hospitality and culture, and is a key gauge for policymakers, has remained more stubborn than expected.

“Indeed at 5.7%, [services inflation] is now 0.4 percentage points above the Bank’s forecast from the May Monetary Policy Report,” said James Smith, developed economist for ING.

“That all but confirms the Bank of England will keep rates on hold on Thursday.

“We’re therefore sticking to our call for the first rate cut to come in August, with a total of three cuts this year.”

Furthermore, experts pointed out that the rates decision is happening two weeks before the UK holds a General Election, which could prompt the Bank to exercise caution.

Policymakers are expected to not make any speeches or public statements during the pre-election campaign period.

Laura Suter, director of personal finance at AJ Bell, said: “It’s highly likely the Bank will want to wait to see the outcome of the election and the final economic plans before making that first cut.

“With no meeting in July, that means all eyes are now firmly on the August MPC meeting for our first potential cut to rates.”

However, financial markets have reduced bets of a rate cut happening in August, with some economists suggesting it could come as late as September.

The MPC may also take into account the latest gross domestic product (GDP) figures which showed that the UK economy recorded no growth in April, but grew 0.7% across the three months to April.

Meanwhile, Chancellor Jeremy Hunt said he hopes the Bank will now cut interest rates so mortgage costs can come down.

“Now we have inflation down, taxes starting to come down and, hopefully soon, mortgages coming down as well,” he said.