Spring statement live: Chancellor outlines efforts to stem cost-of-living crisis

Rishi Sunak has been under pressure to do more to help struggling households deal with surging costs.

Chancellor Rishi Sunak has outlined his spring statement amid pressure to do more to help struggling households.

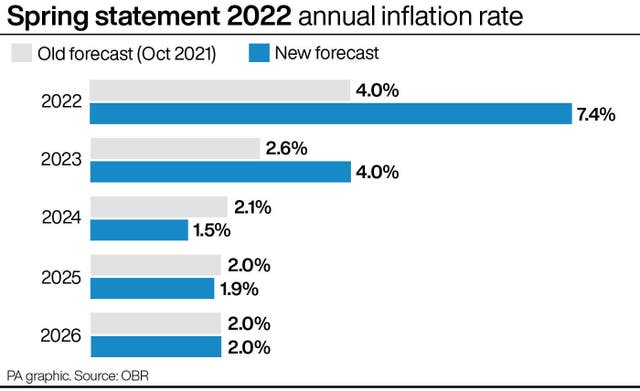

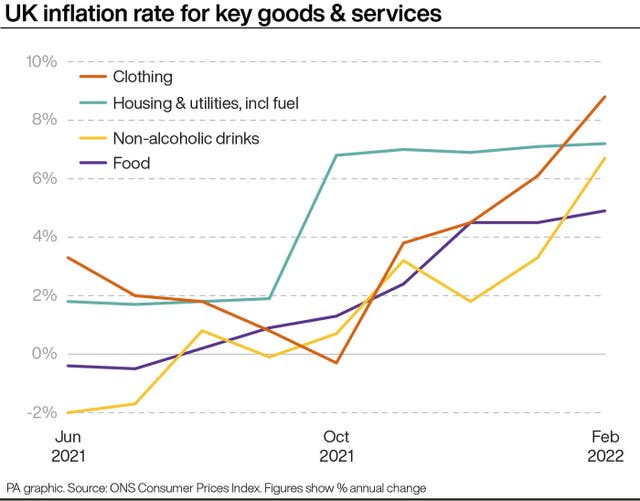

Hours before he stood up in the House of Commons, new figures showed inflation soared to a 30-year high of 6.2% in the 12 months to February.

Rising energy, goods and food prices helped push inflation up, with many of those costs continuing to rocket and Britain facing a cost-of-living crisis.

Here is the latest:

2.02pm

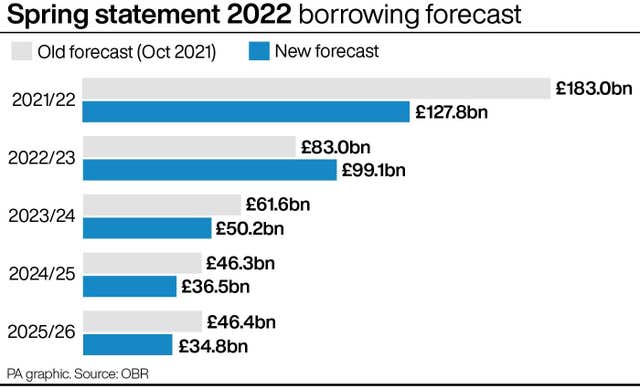

Government borrowing is forecast to be lower this year, the Chancellor said in his spring statement.

2pm

The chair of the all-party environment group has welcomed Mr Sunak’s plan to cut VAT on energy efficiency measures.

Conservative MP Anthony Browne said: “As energy bills rise, it was welcome to see the Chancellor recognise the important role energy efficiency can play by cutting VAT on energy saving materials such as solar panels, insulation and heat pumps to 0%.

“Measures like this can help reduce dependence on expensive gas and I look forward to further announcements on energy efficiency as part of the PM’s energy strategy.”

1.55pm

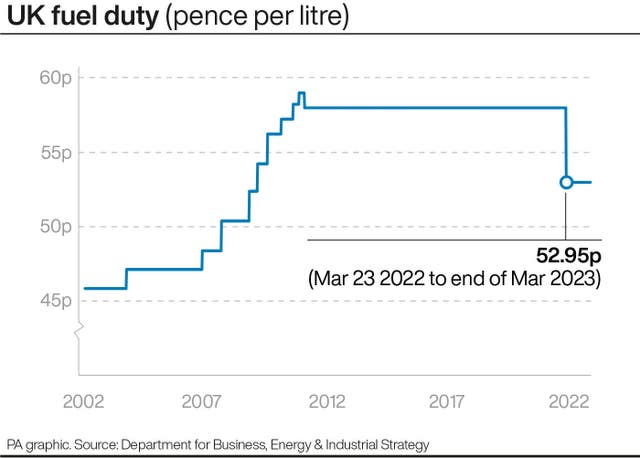

In his spring statement, the Chancellor announced a cut to fuel duty of 5p per litre, lasting until March next year, from 6pm on Wednesday.

1.52pm

Responding to shadow chancellor Ms Reeves, Mr Sunak told her that her statement sounded as if Covid “had never actually happened”.

He said said: “Listening to her statement, it did sound as if Covid and the huge damage that it had done to our economy and public finances had never actually happened. It sounded as if we didn’t need to do things like furlough or support businesses and provide emergency funding to schools, to councils, the NHS.

“Because whilst her party supported all of those policies at the time, they now seem unwilling to pay for them. There is a pattern there, they’re always happy to spend taxpayers’ money, just not take care of it.”

On Labour’s calls for a windfall tax on gas and oil companies, Mr Sunak said: “We know on this side of the House, we want to encourage more investment in the North Sea.

“We want more domestic energy, we want more jobs for the UK and a windfall tax would put that off, which is why the Prime Minister will be bringing forward a comprehensive energy security strategy in the coming weeks to address that.”

1.50pm

The spring statement reviewed the forecast for inflation.

1.47pm

Summing up, Ms Reeves said “the Chancellor has made the wrong choices”.

She said: “The actual reality is that this Chancellor’s failure to back a windfall tax (on oil companies’ profits) and his stubborn desire to pursue a national insurance tax rise are the wrong choices.

“In eight days, people’s energy bills will be rising by 54%, two weeks today the Chancellor’s tax hike will start hitting working people and their employers.

“His national insurance tax rise was a bad idea last September and he’s admitted it’s an even worse one today.

“The Chancellor is making an historic mistake. Today was the day to scrap the tax rise on jobs, today was the day to bring forward a windfall tax, today was the day for the Chancellor to set out a plan to support British businesses.

“But, on the basis of the statement today and the misguided choices of this Chancellor, families and businesses will from now on endure significant hardship as a result.

“The Chancellor has failed to appreciate the scale of the challenge that we face and yet again he’s making the wrong choices for our country.”

1.40pm

Rachel Reeves accused the Chancellor of delivering “increasingly incredible claims”, telling MPs: “Perhaps the Chancellor has been taking inspiration from the characters of Alice In Wonderland – or should I say Alice In Sunak-land, because nothing here is quite as it seems either.”

The shadow chancellor said: “In Sunak-land, the Chancellor claims ‘I believe in lower taxes’ while at the same time as hiking Alice’s national insurance contributions. So Alice asks the Chancellor ‘when did lower taxes mean higher taxes, has down really become the new up?’.

“Alice knows that under the Conservatives taxes are at their highest level in decades as a result of the policies of this very same Chancellor. In fact, this Chancellor is the only G7 finance minister to raise taxes on working people during this crucial year of recovery. Curiouser and curiouser.

“As Alice climbs out of the rabbit hole to leave Sunak-land, she recalls the words of the white rabbit and concludes that perhaps the Chancellor’s reality is just different from yours.”

1.27pm

1.35pm

Shadow chancellor Rachel Reeves said the Government’s plan does nothing for people on the edge of fuel poverty or for pensioners who are facing a “real-terms cut” to their income.

She told the Commons: “At the weekend the Chancellor was asked about fuel poverty and he didn’t even know the numbers.

“It is shameful that he doesn’t, because when Martin Lewis predicts that 10 million people could be pushed into fuel poverty the Chancellor should sit up and listen.

“We know that pensions and social security are not going to keep up with inflation. Pensioners and those on social security are being given a real-terms cut in their incomes.”

1.30pm

The director of the Institute for Fiscal Studies said on Twitter that help for those on benefits was missing from the Chancellor’s statement.

1.25pm

The Chancellor’s choices are making the cost-of-living crisis worse, not better, shadow chancellor Rachel Reeves has said.

Responding to Mr Sunak’s spring statement, Ms Reeves told the Commons: “Today was the day that the Chancellor could have put a windfall tax on oil and gas companies to provide real help to families, but he didn’t.

“Today was the day the Chancellor could have set out a proper plan to support businesses and create good jobs. But he didn’t.

“Today was the day he could have properly scrapped his national insurance hike, he didn’t.

“We said it was the wrong tax at the wrong time, the wrong choice. Today, the Chancellor has finally admitted he got that one wrong.”

1.23pm

1.18pm

To loud cheers from the Conservative benches, the Chancellor concluded his statement by declaring: “My tax plan delivers the biggest net cut to personal taxes in over a quarter of a century.”

1.12pm

Mr Sunak said he will cut the basic rate of income tax from 20p in the pound to 19 before the end of the current Parliament, in 2024.

He said: “A tax cut for workers, for pensioners, for savers. A £5 billion tax cut for 30 million people. It is fully costed and fully paid for in the plan announced today.”

There is help for businesses too, with the Chancellor acting to support small firms reduce their tax bills and make it cheaper to employ staff.

He told MPs: “From April, the employment allowance will increase to £5,000. That’s a new tax cut worth up to £1,000 for half a million small businesses – starting in just two weeks’ time.”

1.08pm

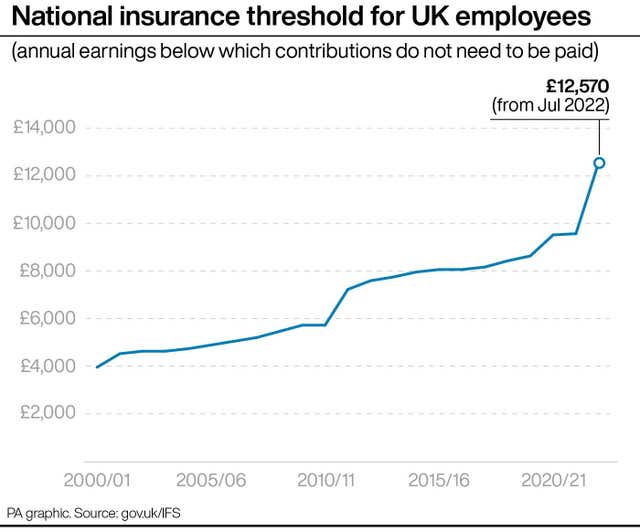

The Chancellor said the threshold for paying national insurance will increase by £3,000 from July.

He also announced he is publishing a new “tax plan”, which will “help families with the cost of living”, “create the conditions for higher growth”, and “share the proceeds of growth fairly”.

He insisted the health and care levy will stay, but added: “A long-term funding solution for the NHS and social care is not incompatible with reducing taxes on working families.

“Our current plan is to increase the NICs threshold this year by £300, I’m not going to do that – I’m going to increase it by the full £3,000, delivering our promise to fully equalise the NICs and income tax thresholds.

“And not incrementally over many years, but in one go, this year. From this July, people will be able to earn £12,570 a year without paying a single penny of income tax or national insurance.

“That is a £6 billion tax cut for 30 million people across the UK. A tax cut for employees worth over £330 a year. The largest increase in a basic rate threshold ever. And the largest single personal tax cut in a decade.”

1.05pm

Mr Sunak said underlying debt is expected to fall steadily from 83.5% of GDP in 2022/23 to 79.8% in 2026/27.

He added borrowing as a percentage of GDP is 5.4% this year, 3.9% next year, then 1.9%, 1.3%, 1.2% and 1.1% in the following years.

He told MPs: “The OBR has not accounted for the full impacts of the war in Ukraine and we should be prepared for the economy and public finances to worsen – potentially significantly. And the cost of borrowing is continuing to rise.

“In the next financial year, we’re forecast to spend £83 billion on debt interest – the highest on record. And almost four times the amount we spent last year.”

Mr Sunak said that is why he will continue to “weigh carefully” calls for additional public spending.

1.03pm

Detailing the measures, Mr Sunak announced VAT will be reduced from 5% to zero on materials such as solar panels, heat pumps and insulation in a bid to help homeowners install more energy saving materials.

He said: “We’ll also reverse the EU’s decision to take wind and water turbines out of scope – and zero rate them as well. And we’ll abolish all the red tape imposed by the EU. A family having a solar panel installed will see tax savings worth over £1,000. And savings on their energy bill of over £300 per year.”

Mr Sunak said the policy will not apply immediately to Northern Ireland due to “deficiencies” in the Northern Ireland Protocol but said support would be offered.

Meanwhile he said the £1 billion Household Support Fund will be available through local authorities from April.

1pm

Mr Sunak also said he will scrap VAT on energy efficiency measures such as solar panels, heat pumps and insulation installed for five years.

He also said he is doubling the Household Support Fund to £1 billion, to help the most vulnerable.

12.57pm

The Chancellor outlined measures to help householders with rising costs. First, he announced a cut to fuel duty of 5p per litre, lasting until March next year.

He said: “Today I can announce that for only the second time in 20 years, fuel duty will be cut.

“Not by one, not even by two, but by 5p per litre. The biggest cut to all fuel duty rates – ever.

“While some have called for the cut to last until August, I have decided it will be in place until March next year – a full 12 months. Together with the freeze, it’s a tax cut this year for hard-working families and businesses worth over £5 billion, and it will take effect from 6pm tonight.”

12.54pm

Mr Sunak said the UK’s actions against Russian President Vladimir Putin’s regime are “not cost-free for us at home” and present a “risk” to the recovery.

He said the Office for Budget Responsibility (OBR) has recognised there is an “unusually high uncertainty around the outlook”, adding: “It is too early to know the full impact of the Ukraine war on the UK economy.

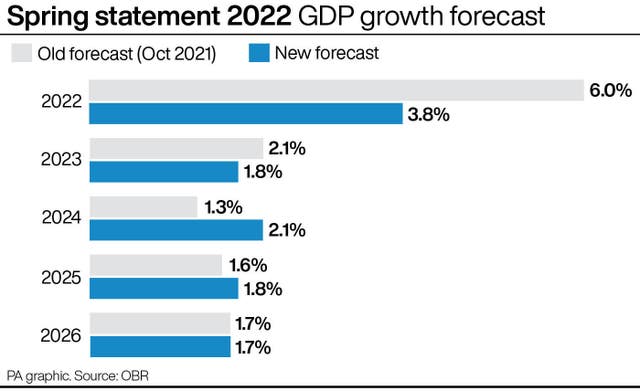

“But their initial view, combined with high global inflation and continuing supply chain pressures, means the OBR now forecast growth this year of 3.8%.

“The OBR then expect the economy to grow by 1.8% in 2023, and 2.1%, 1.8% and 1.7% in the following three years.”

Mr Sunak said the lower growth outlook has not affected the country’s “strong jobs performance”.

12.52pm

Mr Sunak said the Office for Budget Responsibility has downgraded the growth forecast for this year to 3.8%.

12.50pm

Mr Sunak began by insisting: “Today’s statement builds a stronger, more secure economy for the United Kingdom.”

He initially focused on the war in Ukraine and the global fallout from it, telling the Commons: “The sorrow we feel for their suffering, and admiration for their bravery, is only matched by the gratitude we feel for the security in which we live. And what underpins that security is the strength of our economy.

“We should be in no doubt, behind Putin’s invasion is a dangerous calculation: That democracies are divided, politically weak, and economically insecure; incapable of making tough long-term decisions to strengthen our economies.

“This calculation is mistaken.”

12.35pm

Boris Johnson was pressed on the cost of living during PMQs in the Commons prior to Mr Sunak’s speech.

SNP Westminster leader Ian Blackford warned of a “poverty pandemic” and asked the Prime Minister “to match the Scottish Government’s commitment and lift all benefits by 6%”.

The PM responded: “We all recognise inflation, global inflation, is causing a real cost-of-living crisis, not just here but around the world.

“We are doing everything we can to help people. The Chancellor has put another £9.1 billion into reducing the cost of energy for families.”

12.25pm

On rising Consumer Prices Index inflation, the Office for National Statistics (ONS) said it increased across 10 out of the 12 categories that feed into the index, with only communication and education not seeing rises.

Food prices have picked up as the global supply chain disruption and inflation pressures have begun to feed down to the supermarket shelves, with prices rising on a range of staple goods.

But the ONS said the UK is “not alone” in suffering surging costs, with Britain’s measure of CPI broadly in line with that seen in Europe, while it has been rising even faster in America – reaching 8.1% in December.

12.15pm

Mr Sunak has admitted the financial outlook is “challenging” because of soaring inflation and the Russian invasion of Ukraine, Downing Street has said.

No 10 said he provided an update on the economic situation to ministers during Wednesday morning’s Cabinet meeting.

A statement read: “The Chancellor… said that throughout the pandemic, the Government has shown the British people we are on their side and we will continue to stand by them through the uncertainty that we now face.

“He described how the sensible management of the public finances enabled the Government to step in and help people with £9 billion of support for their energy bills in February.

“He said that this Government would continue to take a responsible and sustainable approach in order to be able to grow a stronger, more secure economy for the future.”