Sunak warned Budget has UK facing flat recovery for household living standards

The Chancellor delivered a Budget that increases taxation and spending to levels not seen for decades.

Rishi Sunak’s Budget has the country set for a flat recovery for living standards amid fears the average household could see their tax rise by thousands of pounds during Boris Johnson’s premiership, a think tank has warned

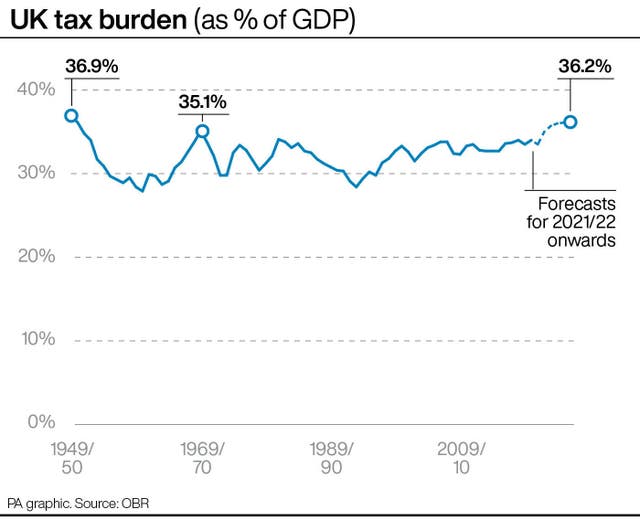

The Office for Budget Responsibility (OBR) said the Budget would leave the overall tax burden at its highest since the final period of Clement Attlee’s post-war Labour administration 70 years ago.

The Resolution Foundation said this burden combined with higher growth, inflation and public spending than previously expected prompted it to warn “that Britain could be set for a flat recovery for household living standards”.

The foundation’s analysis found the Chancellor’s plans will mean by 2026-27 tax as a share of the economy will be at its highest level since 1950, amounting to a £3,000 increase per household since Boris Johnson became Prime Minister.

The weakest decade of pay growth since the 1930s means real wages in the UK are set to fall again in 2022, with the foundation writing: “Real wages are on course to grow by just 2.4% from May 2008 to May 2024 – a far cry from the 36% real wage growth experienced between May 1992 and May 2008.”

Mr Sunak has sought to reassure Tory MPs that he aims to cut taxes before the next election after unveiling his Budget.

He told ITV’s Peston programme that he and the PM had a shared commitment to tax cuts.

“We’re both committed to it, the Prime Minister and I want to do it for people, and that’s why we did it today, we cut taxes for those in the lowest pay, to help them right now and we want to lower the burden of taxation, as I said in my speech I want to see taxes going down by the end of Parliament,” Mr Sunak said.

In an attempt to reassure nervous Conservatives, Mr Sunak earlier told the Commons: “By the end of this Parliament, I want taxes to be going down not up.”

He went further in a meeting of the 1922 Committee of Tory backbenchers by telling them he wants to use “every marginal pound” in the future to lower taxes rather than increase spending.

The Chancellor used an improved economic outlook to set out £150 billion of departmental spending as well as help for people on low incomes to tackle the rising cost of living.

Chief Secretary to the Treasury Simon Clarke said he made “no apologies” for the measures, telling BBC Newsnight: “The Chancellor was very open about the fact that this is something of a philosophical shift.

“What we want to see is to get the economy turbocharged, unlock productivity, and to deliver growth more evenly across UK. That does require some upfront spending.”

Mr Sunak also announced tax cuts for businesses, extra cash for hospitals, a softening of the cut to Universal Credit and a freeze for fuel duty as the nation recovers from the Covid-19 pandemic.

The OBR said the plans will take public spending to the highest share of the economy since the late 1970s, before Margaret Thatcher took power for the Tories.

Key announcements in the Budget included:

– A £2.2 billion package of Universal Credit reforms to allow claimants to keep more of the benefit if they earn more from work.

– Some £7 billion worth of cuts to business rates following a review into the property tax, with the cancellation of next year’s increase in the rates multiplier and a 50% cut to next year’s rates for most retail, hospitality and leisure businesses.

– A major overhaul of alcohol taxation, including cutting the cost of Champagne and prosecco, which Mr Sunak said are “no longer the preserve of wealthy elites” from 2023.

– Pubs will be helped with a new lower rate of duty on draught products, knocking around 3p off a pint as part of the reforms.

– Previously planned rises in alcohol and fuel duties will also be scrapped.

– A cut in the surcharge levied on bank profits from 8% to 3%.

– Flights between airports in England, Scotland, Wales and Northern Ireland will be subject to a new lower rate of Air Passenger Duty from April 2023.

– Whitehall departments will receive a real terms rise in funding as part of the Spending Review, the Chancellor said, amounting to £150 billion by 2024/25.

Former shadow business secretary Pat McFadden responded to the Budget by accusing the Conservatives of being the party of both high taxes and low growth.

The Labour MP told BBC Radio 5 Live: “If we’re going to create wealth in the future then we have to invest in the workforce of tomorrow.

“The Government hasn’t been doing that and that’s again another reason why growth has been so low, and that brings the Chancellor to this choice between higher taxes and spending cuts all the time.

“The Tories are the party of high taxes because they’re the party of low growth.”

The Budget will face further scrutiny on Thursday morning when the respected Institute for Fiscal Studies think tank publishes its comprehensive analysis.

Mr Sunak had promised “help for working families with the cost of living”, with the OBR expecting inflation to reach 4.4% but warning it could hit “the highest rate seen in the UK for three decades”.

The Chancellor was given some leeway for greater spending as a result of a stronger-than-expected recovery from the economic hit from coronavirus, with the OBR predicting the economy will return to its pre-Covid level at the turn of the year.