Bank cuts rates to 0.25% in emergency move to tackle Covid-19 hit

Governor Mark Carney said the economic shock from Covid-19 ‘could prove sharp and large, but should be temporary’.

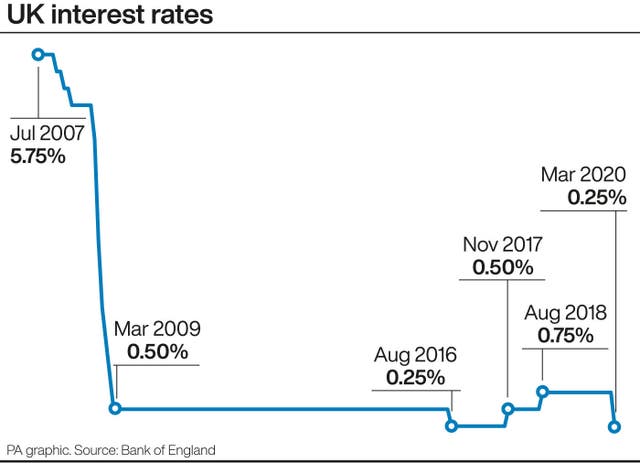

The Bank of England has slashed interest rates from 0.75% to 0.25% in an emergency move to counter a potentially “large and sharp” economic shock from the Covid-19 outbreak.

Outgoing Governor Mark Carney said the cut, which comes alongside further Bank measures to bolster lending, will help “prevent a temporary disruption from causing longer lasting economic harm”.

He also insisted the issues were different to the 2008 financial crisis, saying last time the banks were the problem, this time they can be part of the solution.

The action by the Bank was made in co-ordination with the Treasury and comes ahead of the Chancellor’s Budget on Wednesday, which is expected to see further measures to help Britain cope with coronavirus.

It sees rates taken back down to all-time historic lows, with the Bank also announcing extra action to increase spending by hundreds of billions of pounds to support households and businesses.

These include loosening of rules on lending, although Mr Carney said bankers must not use the cash to boost investor dividends or bonuses for boardrooms.

It is the first cut since August 2016 and the first unplanned rates decision since the financial crisis.

London’s FTSE 100 Index rebounded initially by nearly 2% after the move, but later pared back gains to stand 0.9% higher.

Mr Carney said the package of measures would help the UK manage through an economic shock that “could prove large and sharp, but should be temporary”.

He added: “Although the magnitude of the economic shock from coronavirus is highly uncertain, activity is likely to weaken materially in the UK over the coming months.”

But he insisted there was “no reason” the economic hit caused by coronavirus would end up causing the long-term damage seen after the 2008 financial crisis, “if we handle it well”.

The Bank estimates its rate cut and extra measures could boost growth by more than 1% and said it had the firepower to launch further action, with the potential for rates to go close to zero.

It can also add to its quantitative easing programme to boost the economy if needed.

The Bank’s “comprehensive and timely” package of measures also includes a new facility to encourage banks to lend as much as £100 billion to small businesses and a decision to lower bank capital buffers that it said could bolster their lending power by an extra £190 billion.

Incoming governor Andrew Bailey – who was also at the special meeting to vote on the measures ahead of starting in the role next week – said banks have “no excuses” not to keep lending to households and businesses and pass on the rate cut.

“We expect them to treat customers fairly – that’s what must happen. They know that,” he said.

“The Bank of the England and the FCA (Financial Conduct Authority) will be watching this very carefully,” he added.

Earlier this month, the US Federal Reserve cut its own interest rates in response to the coronavirus fears, and the Bank was under pressure to follow suit.

Businesses across the country have already reported sharp falls in custom, as tourist numbers dry up and more people stay home, and are making preparations for widespread self-isolation.

The FTSE 100 tumbled by 8% on Monday, in one of the biggest single-day falls since the financial crisis, with coronavirus fears and a new oil war between Russia and Saudi Arabia denting the markets and economy.

The British Chambers of Commerce director general, Dr Adam Marshall, said: “Businesses will welcome the decisive action taken by the Bank of England to support the economy at this delicate moment.

“The Bank and UK financial institutions must now work together to ensure that these policy measures translate into real-world support for firms on the ground.”