No sign of households stockpiling ahead of Brexit, figures suggest

Households bought 0.9% fewer items than the same quarter last year, suggesting ‘talk about stockpiling might be just that’, analysts Kantar said.

Households are buying fewer grocery items than last year despite speculation about stockpiling ahead of Brexit, figures show.

Households bought 0.9% fewer items than the same quarter last year, suggesting “talk about stockpiling might be just that”, analysts Kantar said.

However, the market welcomed a return to growth despite the political uncertainty, with sales by value increasing by 0.5% over the 12 weeks to September 8.

Lidl gained an extra 618,000 shoppers compared with last year while a third of British households shopped at the Co-op, helping it to increase sales by 1.8%.

Fraser McKevitt, head of retail and consumer insight at Kantar, said: “As we move closer to October 31, it seems talk about stockpiling might be just that because we’re not seeing any evidence of it at the moment.

“In fact, households bought 0.9% fewer items during the past 12 weeks than they did last year.”

Ocado was again the fastest growing grocery retailer overall as sales increased by 12.7%, with customers buying at least 20% more ice cream, cheese and sparkling wine.

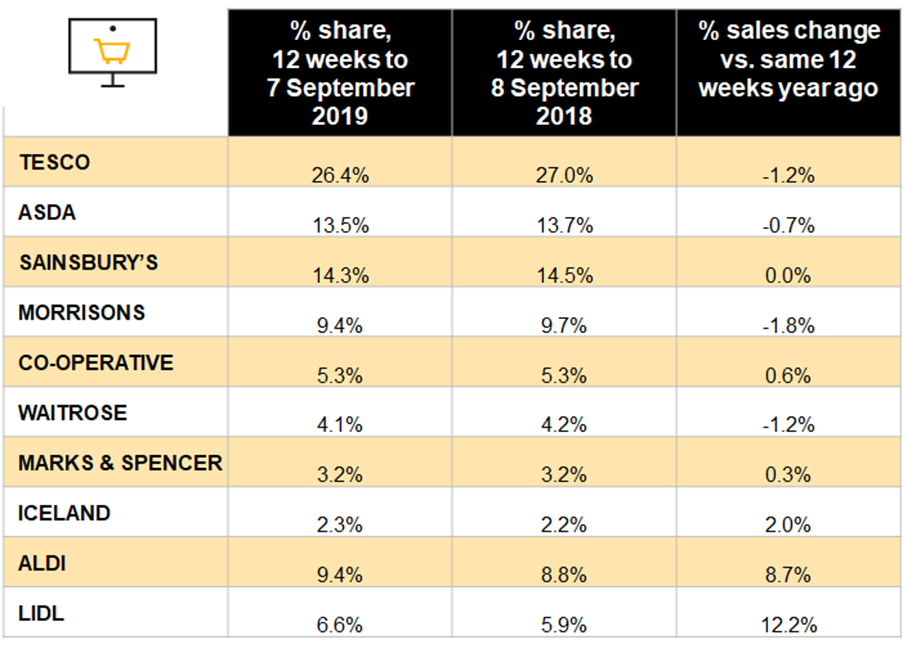

Sales at Asda and Tesco fell by 1% and 1.4% respectively, while Morrisons’ market share dipped to 9.9% as sales fell by 2%.

Waitrose sales declined by 1.3% and Iceland by 2%.

Figures from analysts Nielsen show the late August bank holiday heatwave lifted total supermarket sales by 2.2% over the last four weeks.

Shoppers spent £193 million more than they did in the same period last year, with nearly half of this at discounters and high street value retailers.