Hunt’s tax cut and spending pledges would ‘exacerbate’ finance strain – IFS

Jeremy Hunt has pledged to ‘turbo charge’ the UK’s economy.

Jeremy Hunt would “exacerbate” pressures on public finances with his Tory leadership pledges for higher spending and lower taxes, according to new analysis.

The respected Institute for Fiscal Studies (IFS) think-tank suggests the Foreign Secretary’s proposals would ultimately require spending cuts, tax increases or higher borrowing.

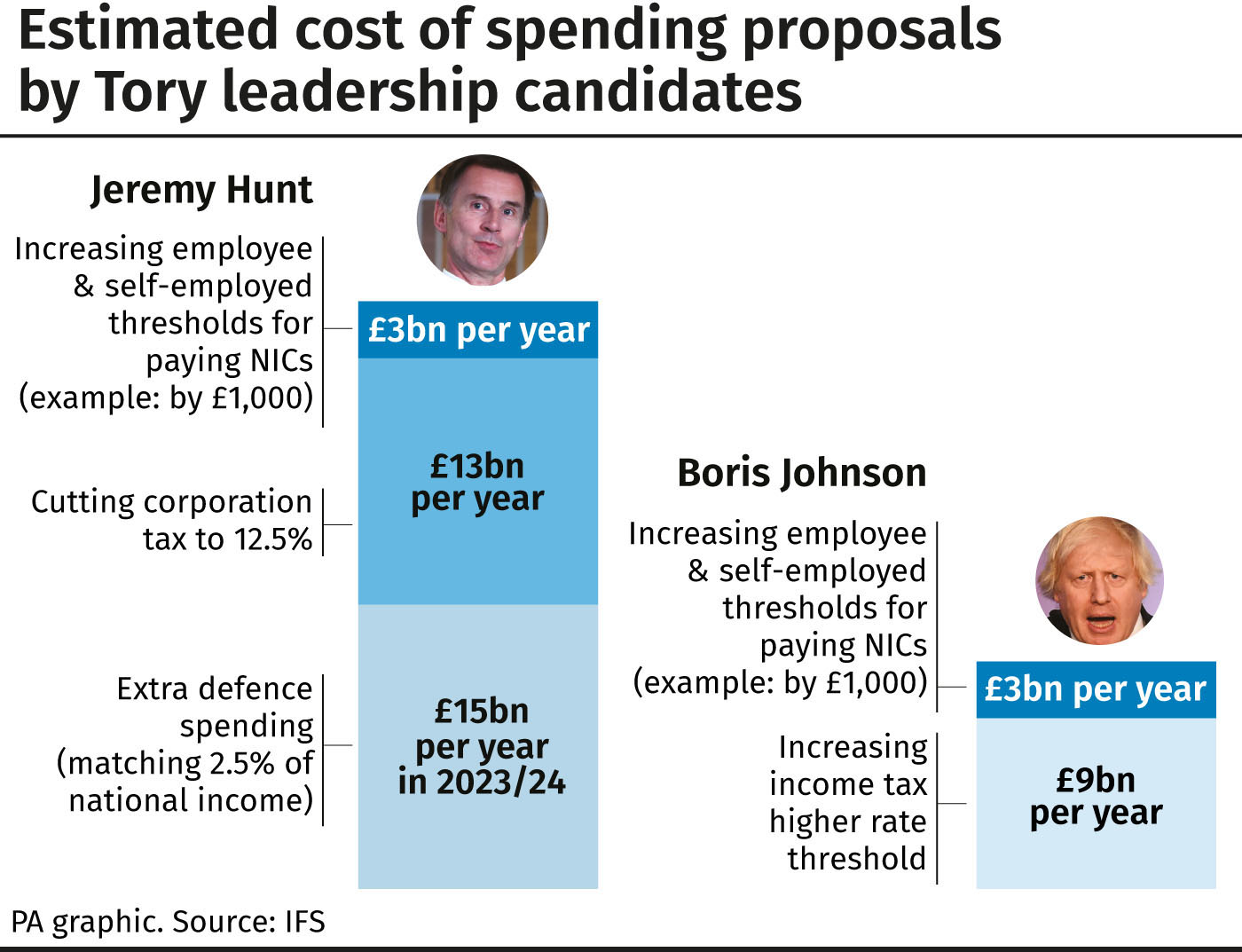

Cutting the main rate of corporation tax to 12.5% would cost £13 billion-a-year in the short term, the research published on Thursday says.

And an additional £15 billion would be spent on the defence budget in four years time as a result of Mr Hunt’s pledge to increase spending to 2.5% of the national income.

The IFS analysis says Mr Hunt’s proposals would “amplify the long-run challenges” to the public purse, with the UK facing spending pressures from an ageing population and rising health costs.

“Mr Hunt’s combination of policy proposals would exacerbate these pressures and widen a gap in the public finances that will ultimately need to be filled through some combination of higher borrowing, tax increases or cuts to other areas of spending,” the report adds.

Mr Hunt has pledged to “turbo charge” the UK’s economy, partly in a bid to apply pressure on the EU during any post-Brexit trade talks.

The IFS says the corporation tax cut from the current level of 19% would not pay for itself because it is “too big for it to be plausible” that higher profits could outweigh revenue losses.

But reducing it to the level of Ireland’s could eventually cost less than the prediction as it would “probably” encourage greater investment in the UK, the report says.

Mr Hunt, battling against Boris Johnson to become prime minister, has proposed to increase defence spending by a quarter over five years from the current level of 2%, to show “Britain is back”.

IFS director Paul Johnson described this as a “radical” measure in comparison to the recent history of cutting defence spending to help finance health and social security spending.

“A £15 billion increase, alongside the proposed corporate tax cut, would leave no scope to relieve the pressure on other areas of public spending without tax rises or a fiscal stance which risked putting debt on a rising path,” he said.

In contrast, the think-tank suggested front-runner Mr Johnson’s pledge to give a tax cut to earners on more than £50,000 would cost around £9 billion and mainly benefit the top 10% of earners.