Carillion: Why did it collapse and what happens next?

Carillion – which reported half-year losses of £1.15 billion – was struggling under nearly £900 million of debt.

What does Carillion do?

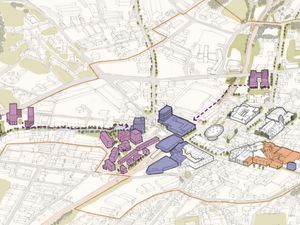

Carillion is one of the UK’s largest construction companies – employing around 43,000 staff globally including 20,000 in Britain – and is known for having worked on the Royal Opera House, the Channel Tunnel, Tate Modern, and the famous doughnut building of the UK’s Government Communications Headquarters (GCHQ) in Cheltenham.

But the Wolverhampton-based company also offers many outsourcing services for the public sector, with contracts to provide school dinners, maintain and operate buildings and estates, security and housekeeping, as well as cleaning and catering at NHS hospitals.

Why is Carillion in so much debt and how did it get this bad?

Carillion – which reported half-year losses of £1.15 billion – was struggling under nearly £900 million of debt and last year reported a £587 million pension deficit.

The company was forced to issued a string of profit warnings in 2017, after a review of its construction contracts found them to be much less valuable than previously thought, resulting in a £845 million write-off.

It prompted the resignation of chief executive Richard Howson, who said the group needed to bolster its balance sheet and was struggling to stay within its borrowing limits.

In December, the firm struck an agreement with its lenders to defer a crucial financial covenant test, but failed this past week to secure more money from banks and the Government that would help keep it afloat.

Neil Wilson, senior market analyst at ETX Capital, said: “This was a case of bad management and pitching for contracts at any price, but the Government and banks could, or maybe should, have done more”.

Why did the Government fail to provide funding?

Carillion is believed to have asked the Government to provide funds of £20 million to help it secure more money from the banks and avoid going into liquidation, but the Press Association understands that ministers were unwilling to offer financial support.

While the Cabinet Office has declined to comment, there are questions as to whether this was an issue of perception, as funding would look like the Government was bailing out yet another private firm.

It is a particularly sensitive topic in the wake of the financial crisis when the UK bailed out major lenders including Royal Bank of Scotland (RBS) and Lloyds.

The Government most recently came under fire after prematurely ending a contract with Stagecoach and Virgin, who had agreed to pay £3.3 billion to run the East Coast rail franchise until 2023, amid concerns that the two companies were considering pulling out due to financial losses on the deal.

What has the Government said?

Cabinet Office Minister David Lidington has said it is “regrettable” that Carillion failed to secure further funding from lenders but warned: “Taxpayers cannot be expected to bail out a private sector company.

“We remained hopeful that a solution could be found while putting robust contingency plans in place to prepare for every eventuality.

“It is of course disappointing that Carillion has become insolvent, but our primary responsibility has always been keep our essential public services running safely.”

Why were Carillion’s problems not caught earlier?

Questions will also be asked of Carillion’s auditor, KPMG, which signed off its 2016 accounts.

Last year Carillion asked KPMG to look into 58 contracts following concerns over late payment.

Later in 2017, the Financial Conduct Authority (FCA) opened an investigation into the “timeliness and content” of announcements made between December 7 2016 and July 10 2017.

It covers a period of turmoil for the HS2 contractor, in which the firm’s share price plunged and its chief executive departed following its profit warnings.

What upcoming projects is Carillion involved with?

The HS2 high speed rail project was one of the most high profile on Carillion’s plate, though it held approximately 450 Government contracts involving the Department for Education, Ministry of Justice and Ministry of Defence.

Over the past six months, the troubled infrastructure giant had secured contracts worth £158 million to deliver facilities management services at more than 230 military sites across the north of England, Scotland and Northern Ireland, and two Network Rail contracts to upgrade infrastructure in the Midlands.

The Government has been criticised for awarding contracts to Carillion despite its financial difficulties.

Are any projects in jeopardy as a result of the collapse?

A number of Carillion’s contracts are likely to be put back out for tender by the Government, including HS2, analysts have said.

Oxfordshire County Council – which struck a 10-year contract with Carillion in 2012 – has said it will take over the company’s services, which includes delivering schools meals, and promised no child would go hungry as a result of the firm’s collapse.

But there is also the question of how its project partnerships will be delivered despite its liquidations.

For example, construction firm Galliford Try has said Carillion’s collapse has left a £60 million to £80 million hole in a joint venture between the two firms and Balfour Beatty to deliver the Aberdeen Western Peripheral Route road project.

Will anybody lose their job?

The Government is set to “provide the necessary funding” to maintain public services and told workers to turn up as usual, assuring them they will be paid.

“For clarity – all employees should keep coming to work, you will continue to get paid. Staff that are engaged on public sector contracts still have important work to do,” Mr Lidington said.

While Carillion is set to continue operating “until further notice”, its pending liquidation puts an unclear number of its 20,000 UK jobs as well as international staff at risk.

Those worried about their job have been told that JobCentre Plus “stands ready” to support any affected employees through its rapid response service.

Staff working directly for liquidated companies will be entitled to redundancy payments.

What will happen to staff pensions?

Retirees already receiving their pensions will continue to receive payments, the Government has assured.

But there are around 27,000 staff involved in Carillion’s defined benefit schemes which are likely to be transferred to the public Pension Protection Fund, which means eligible staff will only get a to-be-determined portion of their promised pensions.

Carillion had already driven up at £587 million pension scheme deficit, according to accounts filed last autumn.

A dedicated helpline has been set up for workers to answer questions and address concerns regarding their pensions: 020 7630 2715.

Which companies stand to benefit from Carillion’s collapse?

A number of Carillion’s peers stand to gain some of its business as a result of the collapse.

Balfour Beatty’s rail and highways business, as well as Kier’s highways and telecoms operations could be in line for new work, alongside Serco’s facilities management services.

Those firms – as well as Mitie, Interserve, and Mears – “are likely to form a key part of client contingency/emergency planning” and be “beneficiaries of market share gain,” according to Peel Hunt analyst Andrew Nussey.

Why was Carillion paying a dividend to shareholders as recently as last year?

According to Carillion’s 2016 annual report, its dividend increased “in each of the 16 years” since the formation of company in 1999.

It states the group paid out £82.7 million to shareholders in 2016 and £80 million in 2015. Carillion said at the time that it “aims to increase the full-year dividend broadly in line with the growth in underlying earnings per share”.

Former pensions minister Steve Webb questioned whether the payouts were acceptable in light of the ballooning pension deficit.

He tweeted: “Is this really acceptable alongside a pension fund deficit over half a billion pounds?”

Carillion was forced to scrap its 2017 dividend following July’s profit warning.

How much were executives receiving in bonuses in the run-up to Carillion’s collapse?

Former chief executive Richard Howson, who headed the company from 2012 until July 2017, pocketed £1.5 million in 2016.

The pay packet included a £122,612 cash bonus and £231,000 in pension contributions.

As part of his departure deal, Carillion agreed to continue paying him a £660,000 salary and £28,000 in benefits until October.

Former finance chief Zafar Khan, who left Carillion in September, will receive £425,000 in base salary for 12 months.

Interim chief executive Keith Cochrane will be paid his £750,000 salary until July, despite leaving the company in February.

According to the group’s pay policy, cash bonuses and share bonuses are subject to a “clawback” provision for two years after payment, but only if the firm’s results were mis-stated or the executive was “guilty of gross misconduct”.

Liberal Democrat leader Sir Vince Cable has come out swinging in the wake of the firm’s collapse saying that the former chief executive “still being paid his salary, plus perks and bonuses” is a “reward for failure that has to be looked into”.

Who owns Carillion?

According to Bloomberg data last updated in November, Hargreaves Lansdown had one of the biggest shareholdings at just over 13%, followed by Barclays at 6.4%, Toronto-Dominion Bank at nearly 6% and Halifax Share Dealing at around 5.5%.