Slower inflation cools interest rate hike speculation

Lower inflation means the Bank of England is less likely to raise interest rates from record lows of 0.25%.

Inflation unexpectedly slowed last month, knocking back the chances of an interest rate hike and easing the pressure on household finances.

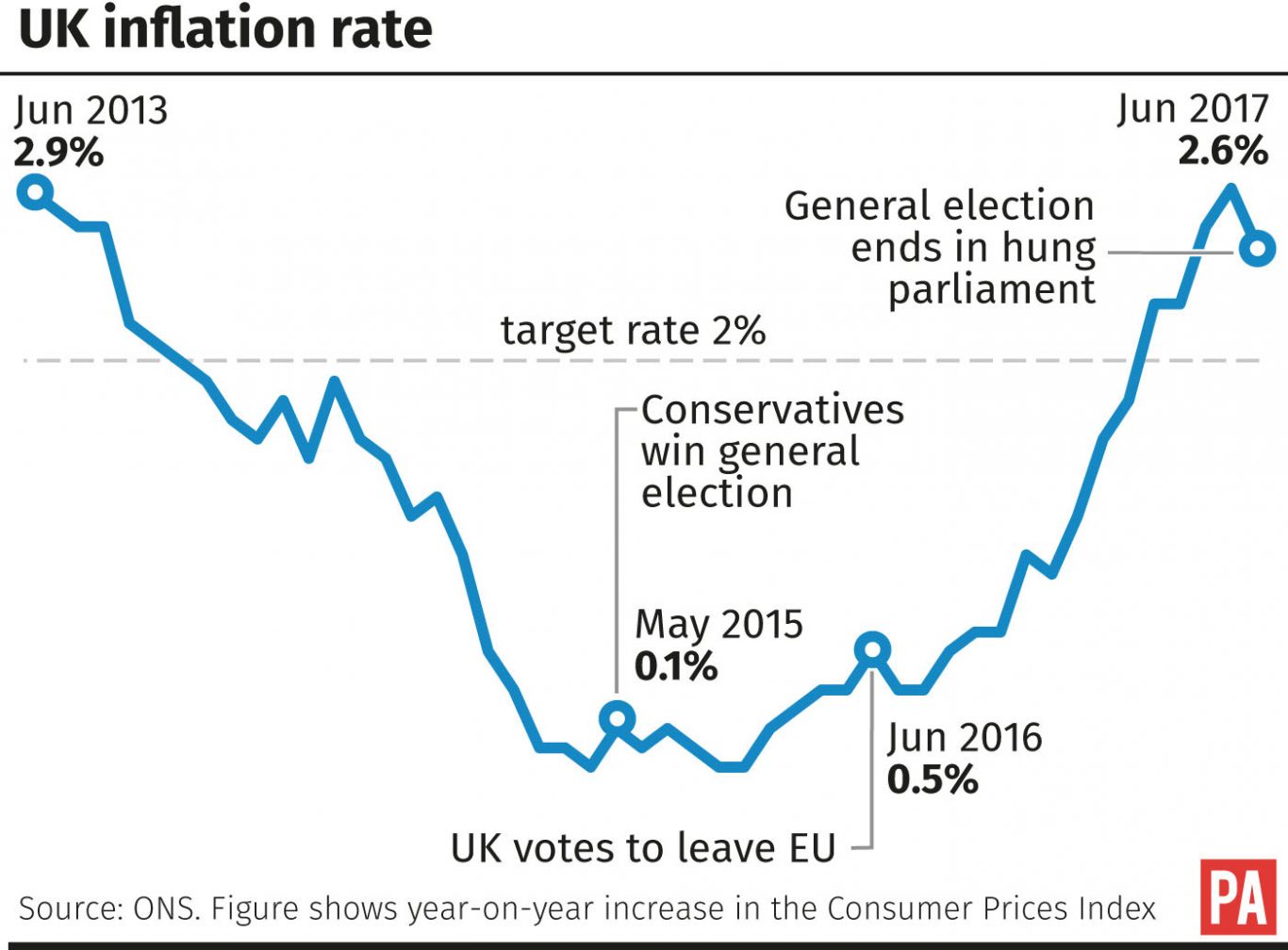

The Office for National Statistics (ONS) said the Consumer Price Index (CPI) measure of inflation fell to 2.6% in June, down from a near four-year high of 2.9% in May.

While the drop was below economists’ expectations of 2.9%, CPI remained above the Bank of England’s target of 2%.

The fall in the cost of living was largely driven by a slide in fuel and computer game prices, while some upward pressure came from the cost of food, which recorded smaller falls for June compared to the same month a year ago.

Sterling took a tumble following the announcement, as lower inflation means the Bank is less likely to raise interest rates from record lows of 0.25%.

The UK currency, which had touched 1.31 US dollars earlier in the day, slipped back to 1.30 US dollars and fell by 0.5% against the euro to 1.13 euro.

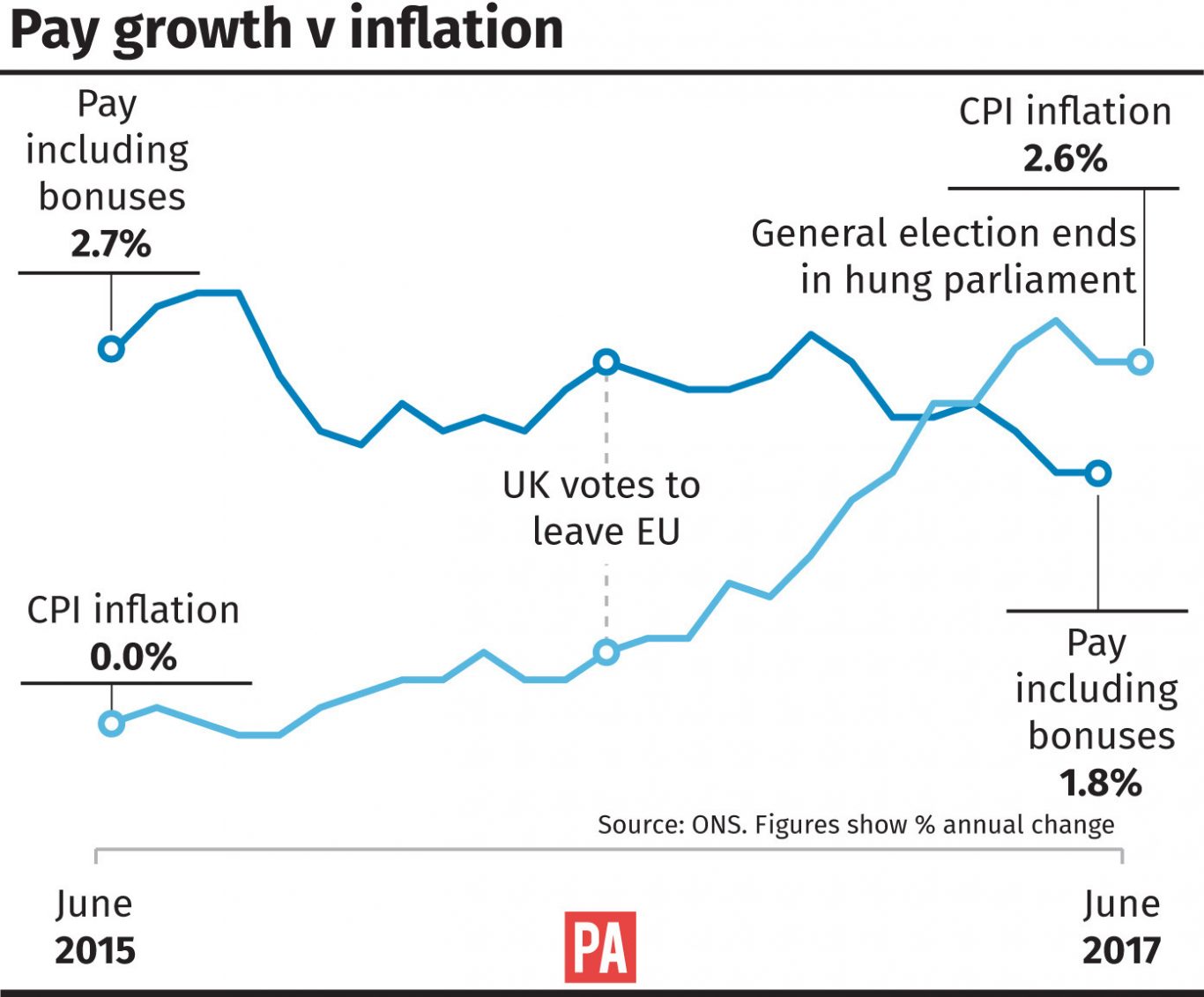

The Brexit-hit pound has caused inflation to march higher up until this point, tightening the squeeze on consumers who are also grappling with sluggish wage growth.

Total pay in real terms sank by 0.7% in the three months to May in contrast to last year, and fell by 0.5% excluding bonuses for the period, according to ONS figures published last week.

Andrew Sentance, senior economic adviser to PwC, said the UK will still see higher inflation this year despite last month’s fall.

He said: “It is still likely that inflation will reach 3% or a little higher in the second half of the year.

“Consumers felt some respite from the inflation squeeze last month, but price rises are still likely to run ahead of wage increases for the rest of this year – continuing the current consumer squeeze and holding back economic growth.”

The main downward pressure on the cost of living came from fuel, which saw the fourth consecutive month of falling prices, dropping 1.1% between May and June.

Petrol prices rolled back by 1.1p over the period to 115.3p per litre, while diesel also declined by 1.4p to 117.3p.

Recreational and cultural goods, which includes computer games, also drove overall prices lower, dropping by 0.1% on the month following a rise of 0.6% last year.

Upward pressure on everyday prices came from food, which saw costs ease back by a smaller 0.3% in June compared with a 0.4% fall for the same month in 2016.

Ben Brettell, senior economist at Hargreaves Lansdown, said inflation could boost the UK economy if the pullback continues.

He said: “If inflation continues to moderate, this could bode well for economic growth – the UK economy is heavily reliant on the consumer, and economists had expected falling real incomes to eventually translate into lower retail sales.

“If this fails to materialise, the economy could see a stronger second half to the year.”