Rising fertiliser prices sends farmers production costs soaring

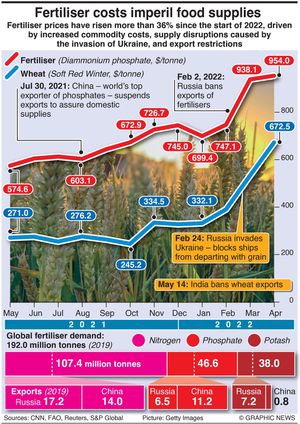

Farmers are continuing to struggle with surging prices for fertiliser as the war in Ukraine disrupts exports from Russia and ramps up production costs.

Nitrogen fertiliser – used to grow crops such as wheat, vegetables and pulses – has risen from £300 per tonne to £1,000. It has led to warnings shoppers could see a spike in the cost of household items like cereal, oil and beer.

Grain prices have also been rising, leaving farmers questioning how fertiliser and other input cost increases can be managed and absorbed.

Andrew Williamson, based outside Bridgnorth, grows about 900 acres of arable crops, such as winter wheat, rapeseed, barley and oats.

He fears he will now be left with drastically scaled down yields after having to reduce the amount of fertiliser he uses.

"The issue we have now is, the cost of fertiliser has increased and will have an impact on our business decisions.

"I don't want to be alarmist about food security and food prices, but off the back of what we've seen in Ukraine and energy security, we also need to start thinking about food security."

Dave Mitchell, fertiliser manager at agricultural supplies firm Wynnstay, said: “Nitrogen fertiliser is made using gas, which makes the cost of fertiliser inseparable from the gas price.

“We’ve seen huge increases in gas prices over the last 12 months, when it increased from 40p per therm to 170p per therm in September 2021. At that point, production of nitrogen fertiliser became potentially unprofitable and some production plants in the UK and across Europe shutdown their activities. The situation has been further exacerbated by the Russia/Ukraine war, with energy prices spiking further.

"When production facilities later reopened, at reduced capacity, the gas price remained high and for a brief period in the winter has reached 450p per therm, so the price of fertiliser also continued to increase. The inevitable impact of this is an increased cost of production of food across sectors.

“Farm businesses are facing challenges as input costs rise, and farmgate prices don’t necessarily change to reflect the rising costs of production. To an extent, farmers can look for efficiencies, but the unavoidable outcome will be an increase in food prices filtering through to supermarket shelves, which we are already starting to see."

Mr Mitchell has warned there is not much to indicate any chance of improvement in the short-term.

"The Russia/Ukraine war is not showing signs of easing up and energy prices are likely to increase again when we enter the autumn and winter months.

“For farmers, focusing on what can be controlled, such as looking to farmyard manure management or wider soil management, will be the most effective way to safeguard their business," he added.

Before Russia invaded its neighbour in February, food insecurity had begun to spike. According to the United Nations, more than half a million people live in famine conditions, increasing more than 500 per cent since 2016.

The UN Secretary-General Antonio Guterres has said that Russia’s war “threatens to tip tens of millions of people over the edge into food insecurity.”

Russia and Ukraine alone produce 30 per cent of the global wheat supply. The US Department of Agriculture predicts Ukraine’s wheat production to fall by 35 per cent to 21.5 million tonnes due to the war. In addition, the price of wheat jumped on international markets after India banned exports on May 14.

Georgie Hyde, NFU regional environment and land use adviser, said: “We are all seeing the global impact of the Russian invasion.

"For Shropshire farmers this includes spiralling feed, fuel and fertiliser costs and for us food security remains paramount – we need to see action to keep productive land in use for growing food and rearing animals.

“I am not convinced we can rely on imports given there are global pressures, nor should we, as many standards overseas are illegal here and we cannot just export our carbon footprint.

“Now is the time for Government to focus on food production and support and secure domestic supply, alongside sensible environmental delivery.”

Meanwhile, responding to high fertiliser costs is one of the themes at this year’s Arable Event, which is taking place on June 15 on the Shropshire/Staffordshire border near Weston-under-Lizard.

Peter Hawkins, West Midlands area manager for agricultural firm Syngenta, said although grain prices are high, high fertiliser costs mean maintaining good crop margins is a fine balance.

“Deciding which winter wheat and barley varieties to plant this autumn sets the scene for this,” said Mr Hawkins. “In these times of risk, growers have to decide whether to try new varieties that may promise extra yield, or to stick with established varieties with a record of delivering reliable performance on-farm over a number of different seasons.”

With growers in the west of the country often facing different considerations to growers in the east – such as greater wet weather disease pressure and more mixed arable and livestock farms – Mr Hawkins said Syngenta plots will demonstrate a range of wheat and barley varieties offering attractive characteristics for the western half of the country at the Arable Event.