Quarter of West Midlands workers earn less than 'living wage'

A quarter of workers in the West Midlands earn below the Real Living Wage, latest figures show.

Charities and trade unions have warned of a “rising tide of in-work poverty” across the country, with millions of workers struggling to make ends meet.

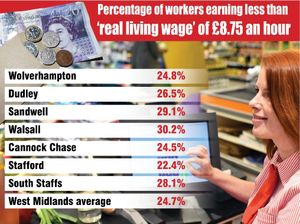

The latest figures from the Office for National Statistics reveal 24.7 per cent of jobs in the West Midlands earn less than the real living wage – around 571,000 workers in total.

In Staffordshire 28.1 per cent of jobs earn less than the real living wage – around 84,000 workers.

In Wolverhampton 24.8 per cent of jobs paid below the Real Living Wage, compared to 26.5 per cent in Dudley and 29.1 per cent in Sandwell. In Walsall the figure was 30.2 per cent, the same as in Telford.

The figure is 24.5 per cent in Cannock Chase, 28.1 per cent in South Staffordshire and 22.4 per cent in Stafford.

They are among a pool of more than six million others across Great Britain ‘struggling to make ends meet’ because their wages are less than they need to cover the basics, according to Frances O’Grady of the Trades Union Congress.

The Real Living Wage, which was £8.75 per hour when the data was compiled but has since been revised to £9, is set by the Living Wage Foundation.

It is higher than the living wage introduced by the Government in 2016, which is the legal minimum employers can pay workers aged 25 and over, and instead calculates the minimum amount a person needs to earn to meet their everyday living costs.

The Living Wage Foundation argues that businesses paying the living wage benefit from more productive and motivated workers.

“If we want to build a modern, dynamic economy, we need to see more businesses step up and join the over 5,000 Living Wage employers committed to pay a fair day’s pay for a hard day’s work,” said director Katherine Chapman.

The figures reveal stark variations across the country, with the proportion of workers earning below the living wage ranging from a low of 6.3 per cent in London city, to a high of 48.7 per cent in Redbridge, in East London.

Invest

Helen Barnard, deputy director of policy at the Joseph Rowntree Foundation, said it was vital to invest in places with low employment and low pay.

She said: “It is totally unacceptable that at a time of record employment we are seeing a rising tide of in-work poverty across the country.

“We need to be more ambitious about improving pay and progression for those at the bottom.”

Unite assistant general secretary Steve Turner said: “For too many people, the insecurity of not knowing if they will earn enough to pay the bills and put food on the table is a daily fact of life.

“It is an obscenity that we have 151 billionaires in this country while 4.1 million children in working households are living in poverty.

“We need to ban exploitative zero and short hours contracts and build an economy where work is stable, secure and pays a decent wage.”

The data also reveals a significant gender gap among living wage earners in the West Midlands.

Women were more likely to earn below the threshold – 30.1 per cent compared to 19.8 per cent of men.

Part-time workers are more affected by low pay than those with full-time jobs.

In the West Midlands, 285,000 part-time workers are taking home less than the living wage – 44.4 per cent of the total.

Just 17.1 per cent of full-time workers were paid less than the living wage.

Low pay 'could be eliminated altogether'

The proportion of low-paid workers in Britain has fallen to its lowest level since 1980, and low pay could be eliminated altogether by the middle of the 2020s, a new report predicts.

And Chancellor Philip Hammond has signalled a willingness to increase the national living wage still further.

The government is consulting on a further increase – potentially to two-thirds of median earnings – in a move experts have said would raise concerns about productivity and affordability for businesses.

Mr Hammond said the national living wage had achieved its original goal of significantly reducing low pay, and the government would now consult on “where to go next” in relation to further increases.

“We are naturally attracted to look at whether it is possible to push up the national living wage to 66 per cent of median earnings over a sensible time period in a way that would allow us to eliminate low pay in the UK,” Hammond said.

“But we would only do that if we can be confident that we can do it without damaging the employment prospects of people with lower skills.”

New research by the Resolution Foundation suggested that the introduction of the national living wage three years ago had “significantly” reduced low pay – from 20.7 per cent of the workforce in 2015 to 17.1 per cent last year.

'Huge change'

The number of low-paid workers fell by almost 200,000 last year, including more than 130,000 women and 120,000 people aged 21-30, said the report.

The biggest falls were said to have taken place in administrative and support services, and retail, where the number of low-paid workers fell by 110,000 in total.

The think-tank said raising the living wage to a level which would end low pay - by setting it at two-thirds of median hourly earnings for workers aged 25 and over - would represent a further “huge change” to the labour market.

Nye Cominetti, of the Resolution Foundation, said: “The national living wage has transformed Britain’s low pay landscape, with the number of low-paid workers falling by 200,000 in the last year alone.

“Women and young people have been the main beneficiaries of a higher minimum wage, whose ratcheting up has not stopped employment rising to a record high.

“It’s great that both main parties want to go even further on raising the minimum wage and eliminate low pay altogether, but such an ambitious move would transform the labour market, and must therefore be approached boldly but cautiously.

“An ambitious but cautious approach that saw the national living wage continue to rise after 2020 - at a faster pace than the minimum wage has increased over its 20-year history -- would put Britain on course to eliminate low pay in the middle of the 2020s, while still giving the Government room for manoeuvre if economic conditions change.”