Win, lose or draw in West Midlands business rate lottery

There are going to be winners and losers across the West Midlands when the new business rates revaluations kick in at the start of April.

The Government has defended the revaluation and ministers say for three quarters of businesses rates will either go down or stay the same.

But there is growing concern that the figures disguise dramatic variations, with some firms winning and others losing with huge hikes in their annual rates bills.

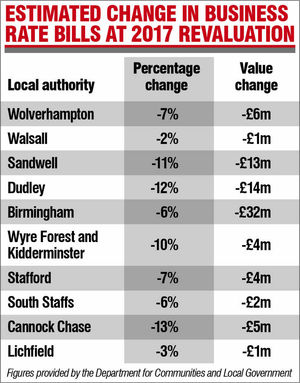

Overall, the figures from the Department of Communities and Local Government say the West Midlands is estimated to see a 10 per cent fall but businesses in affluent areas will see individual big rises with the first re-evaluation of business rates in seven years.

Mark Linning, a valuation expert at Black Country commercial property agents Bulleys, said: "In certain areas we have seen surprising increases in particular for retail properties, some in deprived areas which have struggled to attract tenants for many years. The new industrial and warehouse assessments also suggest that there is a divide.

"Rating revaluations of commercial property are designed to be 'revenue neutral' and to reflect the changes in market conditions rebalancing the rates burden across the country. However, we have seen some areas with surprising increases and in particular some sectors being adversely affected. For example, many trade related properties such as pubs, restaurants, guest houses and hotels will see a considerable rise in their assessments."

Black Country Chamber of Commerce chief executive Corin Crane said there was already a huge backlog of individual appeals against existing rates and there were fears fresh appeals could now take three or four years to be completed creating uncertainty for businesses.

The seven metropolitan borough councils in the region will keep all business rates revenue generated from April 1 when the existing revenue support grant from central Government stops. Overall for the West Midlands rates for shops and stores will go down 11 per cent on average, offices by 16 per cent and industrial sites will fall by seven per cent.

But in and around London companies face massive increases in their business rates. Senior ministers have written to Tory MPs in an attempt to stave off a rebellion over the revaluation. Communities and Local Government Secretary Sajid Javid and Treasury Chief Secretary David Gauke insist most firms will not see any rise in their bills, saying 2017/18 'will see the biggest ever cut in business rates' and 'three-quarters of all businesses, right across the country, will see their rates either fall or stay the same'. And some 600,000 smaller firms will pay no rates at all after a hike in rate relief.

But some pub and restaurant operators have been heavily hit, especially as part of the rates calculation for a pub now includes a percentage of its turnover.

Those with more outlets in town and city centres or on key roads, face bigger bills. It has already prompted a reaction from the Association of Licensed Multiple Retailers (ALMR) – which includes Wetherspoons, Mitchells & Butlers, Pizza Hut and TGI Friday. It has written to Chancellor Philip Hammond saying: "Our sector is the only one to have been impacted by an increase in rateable value in every UK region.

"On average, the pub sector will see a 15 per cent increase and restaurants a 23 per cent increase across the country. All but three UK regions are faced with double digit growth and the average increase in rates bills will be 20 per cent."

Wolverhampton pub owner Marston's has less exposure on the high street. As a result, said Andy Carlill, the operations director for Marston's Taverns which runs around 1,000 of the company's pubs: "Our exposure is not as bad as it might be. But we are keeping a very close eye on the situation, approaching it on a case by case basis with our licensees."

A £3.6 billion transitional fund has been put in place to help companies facing large rate rises by bringing them in gradually over five years. In the Black Country, Corin Crane said the chamber was still waiting to get a full picture of the revaluation locally and the impact on businesses.

"There are winners and losers and some of the small independent retailers that have helped improve the most deprived areas may be hit most," he added.

Mr Crane said another issue was that businesses that ended up with big business rates increases of 40 per cent or more would ultimately have to pass on that increase to customers, which was likely to impact on inflation.

The Greater Birmingham Chambers of Commerce (GBCC) – which includes Kidderminster and parts of southern Staffordshire – is backing growing concerns of some Tory MPs about the likely impact of business rate rises, saying the proposed rise was the 'last thing' retailers needed.