Johnson abandons manifesto pledge on tax hikes to fund social care overhaul

The Prime Minister announced a new UK-wide 1.25% health and social care levy based on National Insurance contributions.

Boris Johnson has abandoned his pledge not to raise the main rates of tax, as he set out plans to overhaul adult social care and deal with the Covid backlog in the NHS.

In a Commons statement, the Prime Minister announced a new UK-wide 1.25% health and social care levy based on National Insurance contributions.

He said the additional revenue would pay for the biggest catch-up programme in the history of the NHS in England, with £12 billion a year to help deal with the backlog of cases built up during the pandemic.

It will also cover the reform of the social care system in England, ending what Downing Street described as “unpredictable and catastrophic” care costs faced by many families.

Mr Johnson acknowledged the new health and social care levy breached a Tory election commitment but told MPs “a global pandemic was in no-one’s manifesto”.

From October 2023, anyone with assets under £20,000 have their care costs fully covered by the state, while those with between £20,000 and £100,000 will be expected to contribute to their costs but will also receive state support.

No-one will have to pay more than £86,000 for care costs in their lifetime.

Scotland, Wales and Northern Ireland will receive an additional £2.2 billion in additional health and social care spending from the levy.

In addition to the health and social care levy, there will also be a 1.25% increase in the dividend tax – to ensure those who receive their income from shares also contribute.

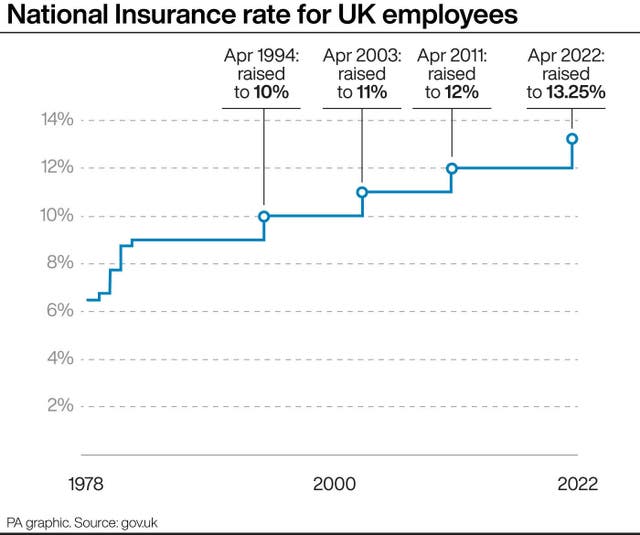

Initially, National Insurance contributions will increase by 1.25% from April 2022 as systems are updated.

From 2023, the health and social care levy element will then be separated out and the exact amount employees pay will be visible on their pay slips.

It will be paid by all working adults, including those over the state pension age – unlike other National Insurance contributions.

Downing Street said that a typical basic rate taxpayer earning £24,100 would contribute £3.46 a week, while a higher rate taxpayer on £67,100 would pay £7.15 a week.

The Prime Minister’s official spokesman said that only a broad-based tax like National Insurance or income tax could raise the kind of sums needed to deal with the problem.

He argued that National Insurance represented a fairer solution as employers – who also benefited from a healthy workforce – would contribute.

“This is a progressive and fair way to raise money,” the spokesman said.

Mr Johnson told MPs he believed the tax hike was “reasonable”.

He said: “No Conservative government ever wants to raise taxes and I will be honest with the House – yes, I accept that this breaks a manifesto commitment, which is not something I do lightly.

“But a global pandemic was in no one’s manifesto and I think the people of this country understands that in their bones and they can see the enormous steps this Government and the Treasury have taken.

“After all the extraordinary actions that have been taken to protect lives and livelihoods over the last 18 months, this is the right, the reasonable and the fair approach.”